Criterios para determinar los Beneficiarios Finales en las Personas Jurídicas:

a) Se considera como beneficiario final a la persona natural que directa o indirectamente a través de cualquier modalidad de adquisición posee como mínimo el diez por ciento (10%) del capital de una persona jurídica.

Por lo que, las personas jurídicas deberán informar sobre los beneficiarios finales indicando los porcentajes de participación en su capital, como así también, de corresponder, información relativa a la cadena de titularidad en los casos en que el beneficiario final lo sea indirectamente, es decir, ostenta la propiedad indirecta a través de otras personas jurídicas.

Para efectos de determinar la propiedad indirecta, el artículo 5 del Decreto Supremo 003-2019-EF, establece los siguientes supuestos:

- Persona natural que posee por intermedio de sus parientes o cónyuge, o al otro miembro de la unión de hecho, de ser aplicable, en conjunto una participación del 10%.

- La propiedad indirecta de una persona jurídica es la propiedad que tiene por intermedio de otras personas jurídicas sobre las cuales la primera tiene participación mínima del 10%; así como la propiedad indirecta que estas últimas tienen, a su vez, a través de otras personas jurídicas, siempre que en estas también tengan una participación mínima del 10%.

- También se considera que existe propiedad indirecta cuando se ejerce a través de mandato sin representación según el artículo 1809 y siguientes del código civil; así como a través de un mandato o cualquier acto jurídico por el cual se otorguen facultades en similares condiciones de acuerdo con la legislación extranjera.

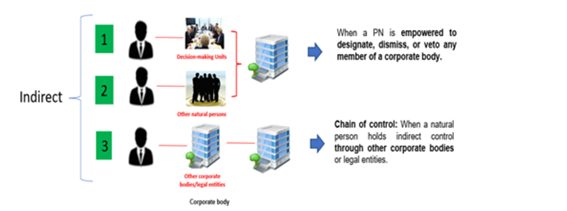

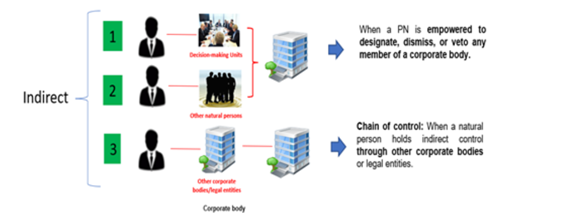

b) Se considera como beneficiario final a la persona natural que, actuando individualmente o con otros como una unidad de decisión (directa), o a través de otras personas naturales o jurídicas o entes jurídicos (indirectamente), ostente facultades, por medios distintos a la propiedad, para designar o remover a la mayor parte de los órganos de administración, dirección o supervisión, o tenga poder de decisión en los acuerdos financieros, operativos y/o comerciales que se adopten, o que ejerza otra forma de control de la persona jurídica.

Cuando se deba determinar, bajo el supuesto de control indirecto, se debe incluir la información relativa a la cadena de control.

Cabe precisar que, las definiciones de control directo e indirecto se encuentran establecidas en el párrafo 5.4 del artículo 5 del Decreto Supremo 003-2019-EF:

Control directo: Cuando la persona natural ejerce más de la mitad del poder de voto en los órganos de administración o dirección o equivalente que tenga poder de decisión, en una persona jurídica.

- Control indirecto: Cuando una persona natural tiene la potestad para designar, remover o vetar a la mayoría de los miembros de los órganos de administración o dirección o equivalente de la persona jurídica, según corresponda, para ejercer la mayoría de los votos en las sesiones de dichos órganos y de esta forma aprobar las decisiones financieras, operativas y/o comerciales o es responsable de las decisiones estratégicas en la persona jurídica, incluyendo decisiones sobre la consecución del objeto y continuidad de la misma.

c) Cuando no pueda identificar a ninguna persona natural bajo los criterios señalados en los supuestos anteriores, se considerará como beneficiario final a la persona natural que ocupa el puesto administrativo superior.

Se debe entender como “puesto administrativo superior” a la Gerencia General o la(s) Gerencias(s) que hagan sus veces o al Directorio o a quien haga sus veces; o al órgano o área que encabece la estructura funcional o de gestión de toda persona jurídica.

Cabe recalcar que en el caso de órganos colegiados u órganos con más de un miembro o de un cargo, son considerados beneficiarios finales cada uno de sus integrantes.

Base Legal: Párrafo 4.1 del artículo 4 del Decreto Legislativo N.° 1372 y artículo 5 del Decreto Supremo N.° 003-2019-EF.

Criterios para determinar los Beneficiarios Finales en los Entes Jurídicos:

¿Qué se entiende por Ente Jurídico?

- Los patrimonios autónomos gestionados por terceros que carecen de personalidad jurídica; o

- Los contratos y otros acuerdos permitidos por la normativa vigente en los que dos o más personas, que se asocian temporalmente, tienen un derecho o interés común para realizar una actividad determinada sin constituir una persona jurídica. Se incluyen en esta categoría:

- Fondos de inversión, fondos mutuos de inversión en valores, patrimonios fideicomitidos domiciliados en el Perú o

- Patrimonios fideicomitidos o trust constituidos o establecidos en el extranjero con administrador o protector domiciliado en el Perú, y

- Consorcios, entre otros.

Base Legal: Literal d) del párrafo 3.1 del artículo 3 del Decreto Legislativo N.° 1372.

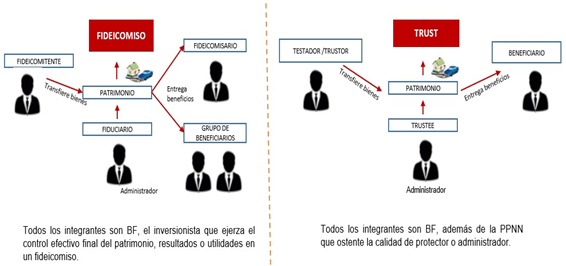

a) En el caso de fideicomisos o fondo de inversión, las personas naturales que ostenten la calidad de fideicomitente, fiduciario, fideicomisario o grupo de beneficiarios y cualquier otra persona natural que teniendo la calidad de partícipe o inversionista ejerza el control efectivo final del patrimonio o tenga derecho a los resultados o utilidades en un fideicomiso o fondo de inversión, según corresponda.

Se entiende por “control efectivo final” a la influencia preponderante y continua en la toma de decisiones de los órganos de gestión o de gobierno del ente jurídico. En el caso de fideicomisos, si aún no se designa a los beneficiarios finales, se considera como beneficiario final a la persona natural en beneficio de la cual se ha creado o cualquier persona natural que ejerza en último término el control del fideicomiso, sea a través de un control directo o indirecto.

b) En otros tipos de entes jurídicos, a la persona natural que ostente una posición similar o equivalente a las mencionadas en el inciso precedente; y en el caso del trust constituido de acuerdo con las fuentes del derecho extranjero, además a la persona natural que ostente la calidad de protector o administrador.

Base Legal: Párrafo 4.2 del artículo 4 del Decreto Legislativo N.° 1372 y artículo 6 del Decreto Supremo N.° 003-2019-EF

Criteria for the determination of the Beneficial Owner in Legal Persons:

a) The individual that directly or indirectly, through any acquisition method, owns at least 10% of the capital of a legal person is considered as Beneficial Owner.

Therefore, legal persons shall inform about the beneficial owners indicating the shareholding percentages, as well as, if applicable, information related to the chain of ownership in cases in which it concerns an indirect beneficial owner, that is, it holds an indirect ownership through other legal persons.

In order to determine the indirect ownership, Section 5 of the Supreme Decree 003-2019-EF establishes the following assumptions:

- Individual who owns through relatives, spouse or the other common law partner, if applicable a shareholding of 10%.

- The indirect ownership of a legal person is the ownership held by means of other legal persons over which the first one has a minimum shareholding of 10%, as well as the indirect ownership that the latter have, in turn, through other legal persons provided that they also have a minimum shareholding of 10%.

- It is also considered that there is an indirect ownership when indirect ownership is exercised through a mandate without representation according to Section 1809 et seq. of the Civil Code, as well as through a mandate or any other legal act for which powers are granted under similar conditions based of foreign legislation.

b) We consider as beneficial owner the individual that acting individually or with others as a decision-making unit (direct) or through other individuals, legal persons or legal arrangements (indirectly), holds powers by means other than ownership to designate or withdraw the majority of Administrative Governing Bodies, management or supervision, or holds decision-making powers on financial, operating and/or commercial agreements adopted or exerting another type of control on the legal persons.

When appropriate, based on the direct control assumption, it will be necessary to include information related to the chain of control.

It is worth mentioning that direct and indirect control definitions are established in paragraph 5.4 of Section 5 of Supreme Decree 003-2019-EF.

- Direct Control: When individuals have more than one half of the voting rights in management bodies or Board of Directors or related having decision-making power on a legal person.

- Indirect control: when an individual is empowered to designate, resign or oppose the majority of member of management bodies or board of directors or a legal entity equivalent, as appropriate, to have the majority of the votes in the meeting of such boards; thus, approving the financial, operating and/or commercial decisions or being responsible for strategic decisions in the legal persons, including decisions on achieving the objective and continuity.

c) When it is not possible to identify any individual under the criterion established in the former assumptions, the individual holding the Senior administrative position shall be considered as beneficial owner.

We understand as “senior administrative position”, the General Management or managements or the Board of Directors or the body or area in charge of the functional or management structure of any legal person.

It is worth mentioning that in the case of governing bodies or bodies with more than one member or position, each member will be considered as beneficial owner.

Legal Basis: Paragraph 4.1 of Section 4 of Legislative Decree 1372 and Section 5 of Supreme Decree 003-2019-EF.

Criteria for the determination of the Beneficial Owner in Legal Arrangements:

What does Legal Arrangement mean??

- Independent equities managed by third parties that lack of legal status; or

- Contracts and other agreements permitted by current regulations in which two or more persons, temporarily associated, have common rights or interest to carry out a specific activity without incorporating a legal person. There are included in this category:

- Investment funds, mutual funds for investment in securities, trust assets domiciled in Peru or

- Trusts or trust assets established abroad with administrator or protector domiciled in Peru, and

- Consortia, among others.

Legal Basis: Item d) in paragraph 3.1 of Section 3 of Legislative Decree 1372.

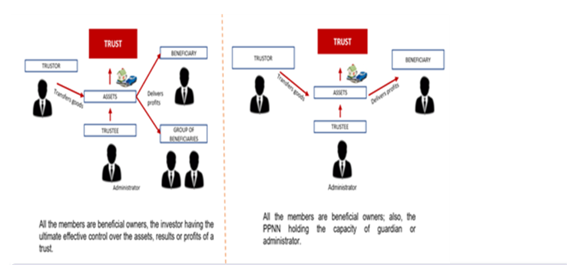

a) In the case of trusts or investment funds, individuals holding the status of settlor, trustee, fiduciary, beneficiary or group of beneficiaries and any other individual acting as participant or investors have ultimate effective control on equity or rights on results or profits in a trust or investment funds, as appropriate.

It is considered as “Ultimate effective control” to the controlling and continuous influence in decision making by the management or governmental bodies of the legal arrangements. In the case of trusts, if beneficial owners have not been appointed, the individual for the benefit of whom it has been created or any individual who ultimately exercises control of the trust, whether through direct or indirect control, is considered as the beneficial owner thereof.

b) In other types of legal arrangements, the individual holding a similar or equivalent position above mentioned in a) and in the case of the established trust, based on foreign law sources; also, the individual holding the capacity of protector or administrator.

Legal Basis: Paragraph 4.2 of Section 4 of Legislative Decree 1372 and Section 6 of Supreme Decree 003-2019-EF.